Low Prices for Oil Cure Low Prices for Oil

Source: Bob

Moriarty (4/27/16)

Veteran investor Bob Moriarty discusses one company that is

poised to benefit from the volatililty in the oil markets.

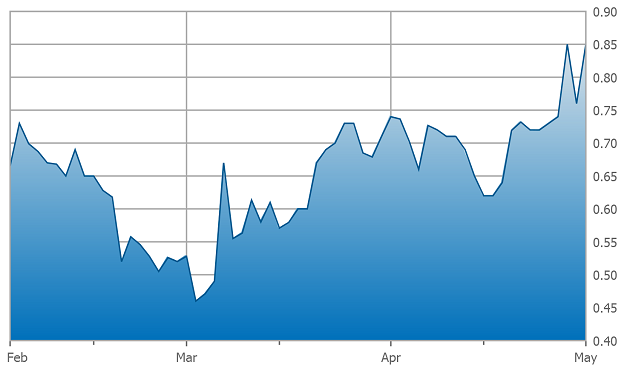

Torchlight Energy Three-Month Chart

As investors we tend to over-think

our investments. Regardless of why oil went down, at some point someone had to

figure out that it was too cheap and should be bought. It didn't make any

difference why oil was so cheap, at some point it was a screaming buy.

That took place on Feb. 11 of this

year as the near futures contract just about touched $26 a barrel. The ratio of

oil to gold was a blistering 48:1, higher by 20% than during the Great

Depression. Low prices cure low prices. In the next six weeks after the low,

the price of oil went up over 70%. I'm perfectly comfortable saying we have seen

the bottom.

The fastest money to be made in

commodities and resource shares are in the initial bounce higher after a

blowout low. We have seen that. But the safest money to be made is after a

correction of that first move up. We have a correction in oil coming. I can't

say if it will be today, tomorrow or a month from now but the rocket higher

brought in a lot of bulls and the market will want to punish the latecomers.

I wrote about an oil company with a giant unconventional oil

field in West Texas last August. Oil was over $50 a barrel and the company's

shares were almost $1 apiece. Oil plummeted and took the price of Torchlight

Energy Resources Inc. (TRCH:NASDAQ) shares with it. Torchlight dropped to a

low of $0.42 in early March. It has since recovered to $0.72.

Commodities hit a 5,000-year low

when measured in constant dollar terms in January. All commodities, not just

gold and oil, were on the sales table at blowout prices. They have completed a

first leg up and are due a healthy correction, but all signals are go for

launch. Oil will be higher a year from now, probably a lot higher. So will

Torchlight.

In September Torchlight announced taking all the risk out of developing the field when it said it

had signed a farm-in agreement providing for a partner to spend $50 million

in development in the Wolfpenn/Orogrande field. Torchlight owns a 95% interest

in the project measuring 168,000 acres with 1,300 feet of pay zone. If you use

the metrics from the similar Delaware and Midland basins, the Orogrande project

could yield 156 sections containing 4 to 6 million barrels per section.

Torchlight's financial partner, Founders Oil and Gas, will contribute $50

million to development and at the end will own 50% of Torchlight's interest.

The deal with Founders gives us a

metric with which we can measure the relative value of Torchlight simply based

on what Founders was willing to pay. If Founders' 50% is worth more than $50

million and it has to be or it wouldn't have done the deal, then Torchlight's

remaining 50% also is worth a minimum of $50 million. As I write, the market

puts a value of $25.5 million on the company. Naturally I think it will go up a

lot even if oil didn't go up as I believe it will.

On April 25, 2016, Torchlight announced starting to drill what they call the University

Founders B-19 #1 well. Drilling will be complete in a few weeks. It's a

vertical well intended to help make plans for the field development. Torchlight

and Founders will need a lot of vertical wells to prove up the field so it

really doesn't matter what the price of oil is today. We will need oil in the

future, so low prices for oil today only mean their drilling and labor costs

are far lower than they were a year or two ago and they have to drill anyway.

Torchlight is not a single trick

pony. In early April it announced an agreement to purchase a 66.66% working interest

in 12,000 acres in the Midland Basin. Its plan is to do exactly what it has

done in the Orogrande project, farm out a partial interest to a larger company

in exchange for financing the work.

Torchlight is a low-cost pure call

on the price of oil. With excellent management in place and cash in the

treasury, it is taking advantage of a disastrous market for others to increase

its end potential.

I own shares bought at a higher

price. I own shares bought lately and I have participated in a couple of PPs. I

am biased. They are advertisers and I have a large vested interest in their

success. Do your own due diligence.

Bob and Barb Moriarty brought 321gold.com

to the Internet almost 14 years ago. They later added 321energy.com to

cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both

sites feature articles, editorial opinions, pricing figures and updates on

current events affecting both sectors. Previously, Moriarty was a Marine F-4B

and O-1 pilot with more than 820 missions in Vietnam. He holds 14 international

aviation records.

Want to read more Gold Report

interviews like this? Sign up for our free e-newsletter, and you'll learn when

new articles have been published. To see recent interviews with industry analysts

and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Bob Moriarty: I or my family own shares of the following companies mentioned in this interview: Torchlight Energy Resources Inc. My company has a financial relationship with the following companies mentioned in this interview: Torchlight Energy Resources Inc. I determined which companies would be included in this article based on my research and understanding of the sector. Statement and opinions expressed are the opinions of Bob Moriarty and not of Streetwise Reports or its officers. Bob Moriarty is wholly responsible for the validity of the statements. Bob Moriarty was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: Torchlight Energy Resources Inc. The companies mentioned in this interview were not involved in any aspect of the article preparation or editing so the expert could comment independently about the sector. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

1) Bob Moriarty: I or my family own shares of the following companies mentioned in this interview: Torchlight Energy Resources Inc. My company has a financial relationship with the following companies mentioned in this interview: Torchlight Energy Resources Inc. I determined which companies would be included in this article based on my research and understanding of the sector. Statement and opinions expressed are the opinions of Bob Moriarty and not of Streetwise Reports or its officers. Bob Moriarty is wholly responsible for the validity of the statements. Bob Moriarty was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: Torchlight Energy Resources Inc. The companies mentioned in this interview were not involved in any aspect of the article preparation or editing so the expert could comment independently about the sector. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

Streetwise

– The Energy Report is Copyright ©

2016 by Streetwise Reports LLC. All rights are reserved. Streetwise Reports LLC

hereby grants an unrestricted license to use or disseminate this copyrighted

material (i) only in whole (and always including this disclaimer), but (ii)

never in part.

Streetwise

Reports LLC does not guarantee the accuracy or thoroughness of the information

reported.

Streetwise

Reports LLC receives a fee from companies that are listed on the home page in

the In This Issue section. Their sponsor pages may be considered advertising

for the purposes of 18 U.S.C. 1734.

Participating

companies provide the logos used in The

Energy Report. These logos are trademarks and are the property of the

individual companies.

101 Second St., Suite 110

Petaluma, CA 94952

Petaluma, CA 94952

Fax: (707) 773-5020

Email: info@streetwisereports.com

Connect with us on Facebook and Twitter!

Follow @EnergyNewsBlog