$50/Barrel Oil Won't Last: Why Chances of a Breakdown Are High

Source:

Clive Maund (6/3/16)

It still looks like

oil is topping out here at about the $50 level after its substantial recovery

uptrend from its February low. While we cannot be sure until it breaks down

from its uptrend, the chances of its doing so soon look high for various

reasons.

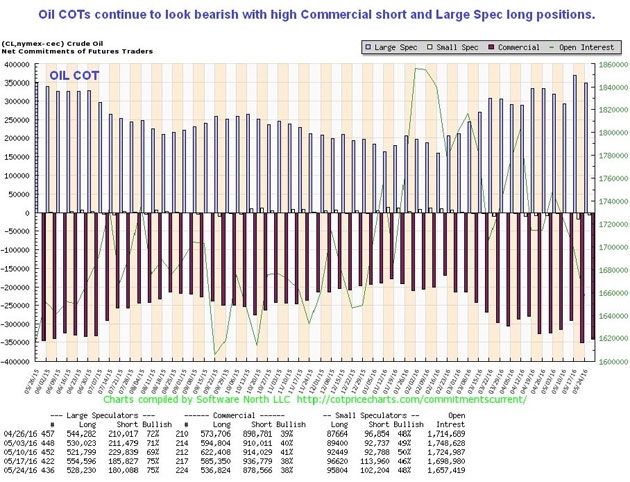

One is that the

current intermediate uptrend has been going on for a long time now and has

resulted in a persistent overbought condition. Another is that it is quite some

way above its 200-day moving average, which, although it has turned up, is

still only rising gently. Another is that it has arrived at resistance at the

upper boundary of a trading range that developed last fall. Still another is

that its latest COT looks bearish, with Commercial short and Large Spec long

positions being at their highest for about a year (see chart above). Finally,

the broad market looks ready to roll over after its rally up to resistance of

recent days, and if it does, it is likely to take oil down with it, probably

against the background of a continued rise in the dollar.

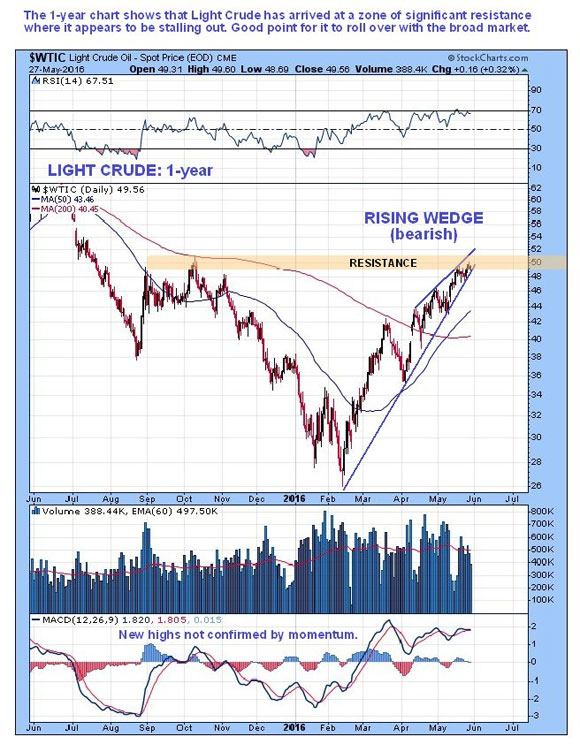

The 1-year chart shows

that the advance has brought Light Crude up to a zone of significant

resistance, where it appears to be stalling out. This is a good point for it to

turn down again, probably in tandem with the broad market. . .

A factor that has

supported oil prices for much of this year has been the persistent

"contango," which means that prices for future delivery of oil are

significantly ahead of spot prices, probably caused by the market's erroneous

expectation that the shutting down of capacity will lead to a shortage and thus

higher prices. This belief, coupled with high production, has led to an armada

of ships bulging with crude, sitting offshore, with the owners holding the

mistaken belief that they will get higher prices later.

Thus, the dramatic

development of the past few weeks, during which the contango has collapsed so

that it has already become uneconomic to store oil offshore, means that the

screw is now being turned on owners storing oil offshore. With the market

glutted, and contangos collapsing, owners are being forced into the bizarre

position of resorting to debt-funded storage, a highly anomalous solution that

is clearly untenable over the longer-term.

What this means is

that a large number of bulging ships are soon going to race to shore to

disgorge their cargoes for what they can get, a development that could magnify

the downturn in oil that we are expecting into a rout of plunging prices, made

worse by the fact that prices have been artificially elevated by excess storage

in expectation of rising prices, which has so far been a self-fulfilling

prophecy

But when all storage

capacity, onshore and offshore, has been used up, that's it, it's game over,

and that appears to be the situation that we have arrived at.

Clive Maund has been president of www.clivemaund.com,

a successful resource sector website, since its inception in 2003. He has 30

years' experience in technical analysis and has worked for banks, commodity

brokers and stockbrokers in the City of London. He holds a Diploma in Technical

Analysis from the UK Society of Technical Analysts.

Want to read

more Energy Report articles like this? Sign up for our free e-newsletter, and you'll

learn when new articles have been published. To see a list of recent interviews

with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the content preparation or editing so the author could speak independently about the sector. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the content preparation or editing so the author could speak independently about the sector. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

All charts courtesy of

Clive Maund

This article first appeared on May 30, 2016 on clivemaund.com

This article first appeared on May 30, 2016 on clivemaund.com

Streetwise

– The Energy Report is Copyright ©

2016 by Streetwise Reports LLC. All rights are reserved. Streetwise Reports LLC

hereby grants an unrestricted license to use or disseminate this copyrighted

material (i) only in whole (and always including this disclaimer), but (ii)

never in part.

Streetwise

Reports LLC does not guarantee the accuracy or thoroughness of the information

reported.

Streetwise

Reports LLC receives a fee from companies that are listed on the home page in

the In This Issue section. Their sponsor pages may be considered advertising

for the purposes of 18 U.S.C. 1734.

Participating

companies provide the logos used in The

Energy Report. These logos are trademarks and are the property of the

individual companies.

101 Second St., Suite 110

Petaluma, CA 94952

Petaluma, CA 94952

Connect with us on Facebook and Twitter!

Follow @EnergyNewsBlog