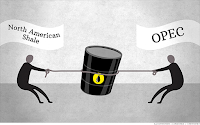

OPEC Still Holds Sway Over Oil Market

From Forbes:

So, why did the price go right back up the last two weeks after tanking so dramatically towards the end of December? The answer has largely to do with recent actions taken by OPEC+ nations.

First, despite all the stories we saw throughout December that the OPEC+ announcement at the first of that month that it would cut its collective crude export volumes by a total of 1.2 million bopd was an inadequate action, crude prices began moving upwards as the cuts began fully going into effect in early January.

Second was the announcement by Saudi Arabia that it plans to cut its own production to just 7.1 million bopd by the end of January, a drop of more than 3 million bopd from its September peak. The simple fact of the matter is that no other country on earth has the ability to raise and cut its oil production volumes so dramatically in such a short period of time as does the House of Saud.

By the same token, no other group of oil producing countries has the ability to pool its resources to impact oil prices in the way the OPEC+ group does. There is no question that OPEC+ spent much of the second half of 2018 mis-judging the market by adding more export volumes in anticipation of the renewal of U.S. sanctions on Iran. But the truth of that matter is that they were simply caught off-guard by the last minute decision by the Trump Administration to grant waivers to China and India, two of Iran's largest customers.Read on by clicking here.