Report: Ohio Counties Have Received Nearly $142 Million in Real Estate Property Taxes from Utica Shale Production

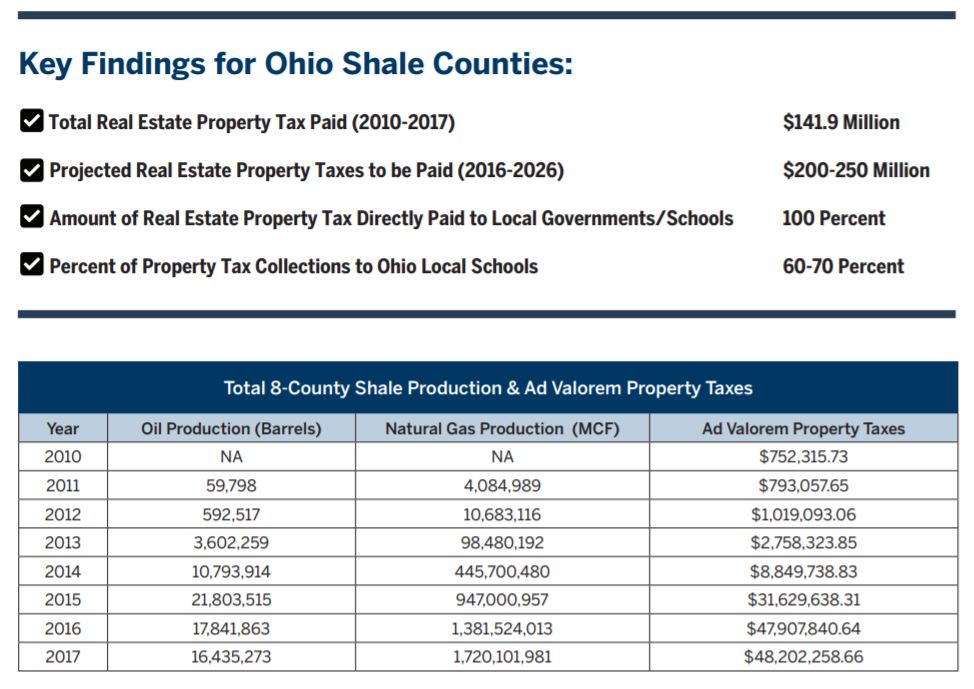

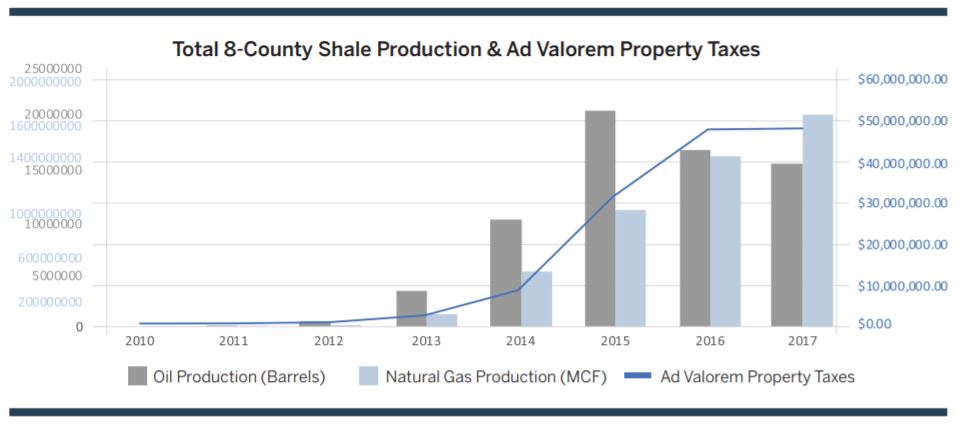

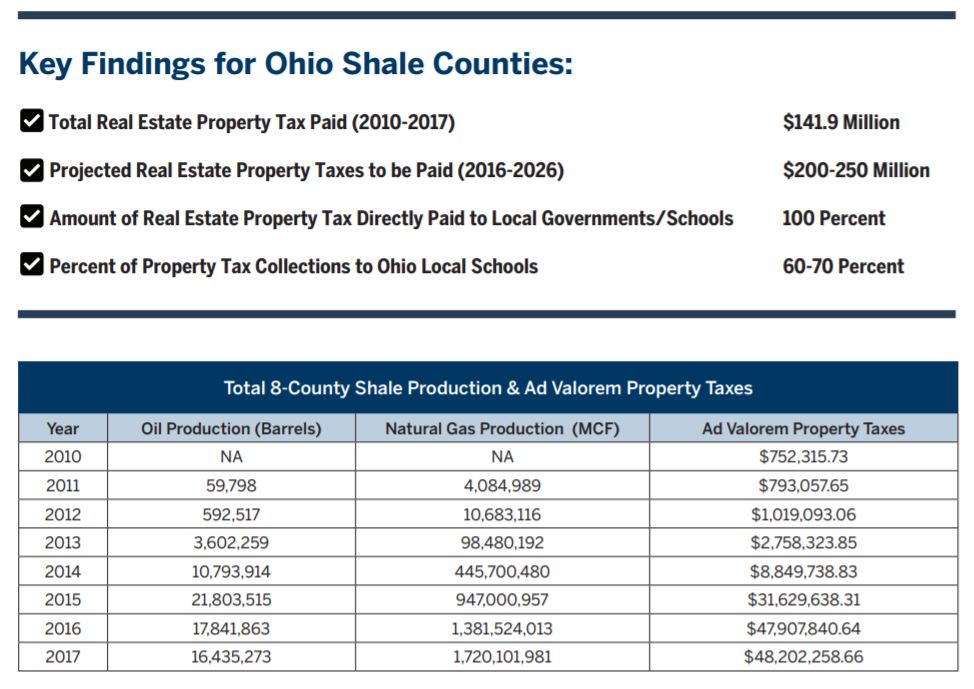

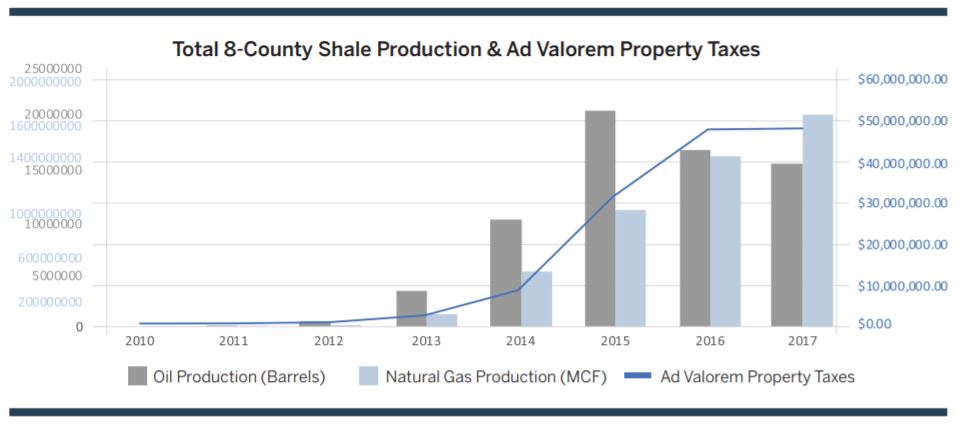

Eight of Ohio’s top Utica Shale development counties collected more than $141.9 million in real estate property taxes on oil and natural gas production since 2010, according to an updated report by Energy In Depth and the Ohio Oil and Gas Association.

The Utica Shale Local Support Series report entitled, “2019 Update: Ohio’s Oil and Gas Industry Property Tax Payments,” analyzes the economic impacts of oil and natural gas real estate property (or ad valorem) taxes paid in these counties from 2010-2017: Belmont, Carroll, Columbiana, Guernsey, Harrison, Jefferson, Monroe and Noble.

Data was collected through Freedom of Information Act requests, and builds on EID and OOGA’s previous 2017 reports on real estate property taxes and road use management agreements.

The Utica Shale Local Support Series shows the real dollars being paid to Ohio’s communities. As Harrison Hills Superintendent Dana Snider said:

“Harrison Hills has experienced a great working and supportive relationship with the oil and gas industry. Part of that support comes from the ad valorem tax, which in large part comes to the district. Those dollars have allowed us to reinvest in our students, staff and facilities to provide a state of the art, nurturing and creative learning environment that our community is proud of.”

Here are the key findings of the 2019 updated report:

To read the full report or view county specific information:

To read the full report or view county specific information:

“Harrison Hills has experienced a great working and supportive relationship with the oil and gas industry. Part of that support comes from the ad valorem tax, which in large part comes to the district. Those dollars have allowed us to reinvest in our students, staff and facilities to provide a state of the art, nurturing and creative learning environment that our community is proud of.”